Small Business, Big Opportunity

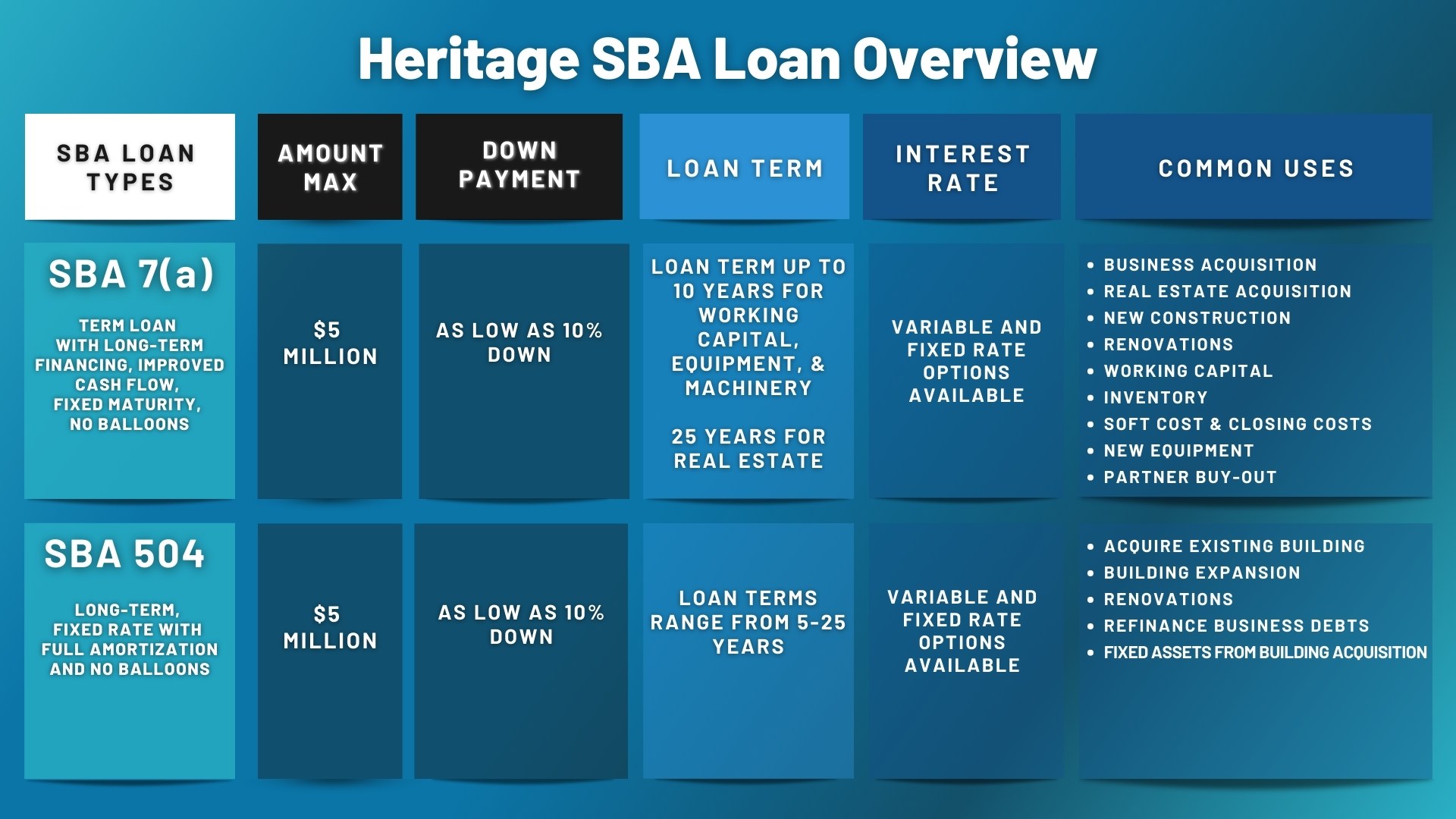

The Small Business Administration (SBA) functions as the primary source for government-supported business loans, enabling small business proprietors to secure funding with reduced equity compared to what is typically required for a traditional loan due to a portion of the SBA loan being government-guaranteed. Our SBA 7(a) and SBA 504 loan programs offer benefits such as fast, local service, online applications, a down payment as low as 10 percent, and more.

Small Business Solutions

We understand that businesses come in all shapes and sizes, so we offer Business Checking accounts that can be custom fit for your product and service offering, from Money Market Checking Accounts to Small Business Checking Accounts, we have an option for you.

Want to learn more before continuing? Read our blog post.

Small Business Checking

A checking account designed for small businesses with moderate transaction volumes.

- $50 minimum opening deposit

- 250 free transaction items per month (see fee schedule)

- No monthly service charge or minimum balance

- $2 monthly paper statement fee if not enrolled in eStatements

- Free Digital Banking

- Free Bill Pay

- Free eStatements

- Business Debit Card

Small Business Testimonials

Hear from Heidi Griese, owner of Flowers & More, and Zac and Jessica Parsons, owners of Honey + Moon Coffee Co, as they share how working with Heritage impacted their small businesses.

Hear from Matt Bertram, owner of Bertram Chiropractic & Wellness, as he shares how working with Heritage and receiving an SBA Loan impacted his business.

Subject to business review and approval. Property insurance may be required.

Go to main navigation