Non-Profit Checking Account Features

At Heritage, you can trust our team of experts to take care of your non-profit with checking account solutions tailored for your organization's needs. Enjoy the benefits of our Checking designed exclusively for 501 organizations. Say goodbye to monthly fees and minimum balance requirements, this account offers zero fees and a high APY. Benefit from a free debit card, statements, and even your first set of checks on us.

Let Heritage help you help others.

Trust Heritage to empower your organization with financial solutions that truly make a difference, so you can focus on your mission.

Exclusive Benefits

|

|

Digital Banking with Benefits like Mobile Check Deposit, Card Controls, and More! |

|

|

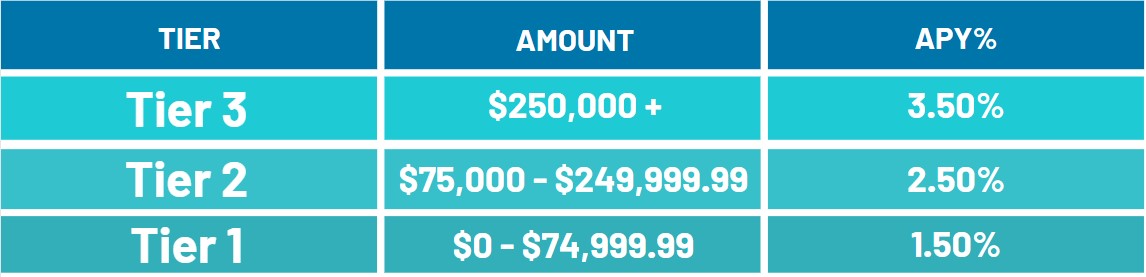

A Business Checking account with Zero Fees or Minimum Balance Requirements that Pays a High APY1 |

|

|

Free Statements and First Set of Checks |

|

|

Free Debit Card with Card Controls Easily Accessible in Digital Banking |

|

|

Business Checking Account Options |

|

|

Specialized Support for Non-Profits |

High Returns to Support your Mission

Ready to get started?

You can open your Non-Profit Checking Account quickly and easily at Heritage, just make sure to have this information ready before you apply.

- $50 for required initial deposit to open account

- All ID's for those who will be listed on the account

- Meeting minutes stating who should be on the account

Your Organization's Solution for all Banking Needs

Managing cash flow and tracking spending can be challenging for non-profits, especially with day-to-day operating costs, larger projects, and fundraising events. Simplify your spending with a Heritage Business Platinum Rewards Visa® Credit Card, specifically tailored to meet your business needs.

1APY=Annual Percentage Yield. The Non Profit Rewards Checking Account tier dividend rate and APY as of 08/01/2024 are subject to change daily. Dividends compounded monthly. Minimum $50.00 to open account. 501 tax exempt form must be provided at account opening. Program rates, terms, and conditions are subject to change without notice. Membership restrictions may apply.

Go to main navigation